Optimizing Kubernetes Pod Placement for Secure and Highly Available Financial Applications

DevOps

– 6 Min Read

In today’s fast-paced digital financial world, financial institutions rely on cloud-native micro-service architectures to ensure seamless customer experiences, security, and compliance. Kubernetes has emerged as the go-to solution for managing containerized applications (where ‘pods’ are the smallest deployable units that contain one or more containers), but intelligent pod placement is critical to ensure high availability, security, and regulatory compliance. This blog explores how Kubernetes pod placement strategies – using node affinity, pod affinity, and pod anti-affinity – directly address these three critical requirements in financial applications. Based on our practical experience from Kubernetes consulting services, we’ll examine practical examples of how these techniques can be implemented to strengthen security postures, maintain regulatory compliance, and guarantee high availability for mission-critical financial services.

The Challenge: Secure, Compliant, and Available Financial Systems

Financial applications operate in highly regulated and security-sensitive environment. Their digital infrastructure must support:

- Regulatory Compliance (e.g., GDPR, PCI-DSS, SOC 2)

- High Availability (HA) (avoid downtime for critical services)

- Performance Optimization (run workloads on suitable hardware)

- Security & Isolation (prevent unauthorized workload interactions)

- Zero Trust Security (restrict access and enforce strict policies)

- Auditability & Logging (maintain logs for compliance and incident response)

Kubernetes pod placement policies directly address these requirements by controlling where workloads run and how they interact, as demonstrated in the following strategies.

-

1. Node Affinity: Running Workloads on Specific Nodes

👉 What is Node Affinity? It allows Kubernetes to schedule pods only on specific nodes based on labels.

Use Case 1: GDPR Compliance – Data Residency Requirements

-

EU regulations mandate that customer data processing happens within European data centres.

-

Solution: Use node affinity to schedule workloads only on EU-based nodes.

-

Benefit: Ensures compliance with legal requirements.

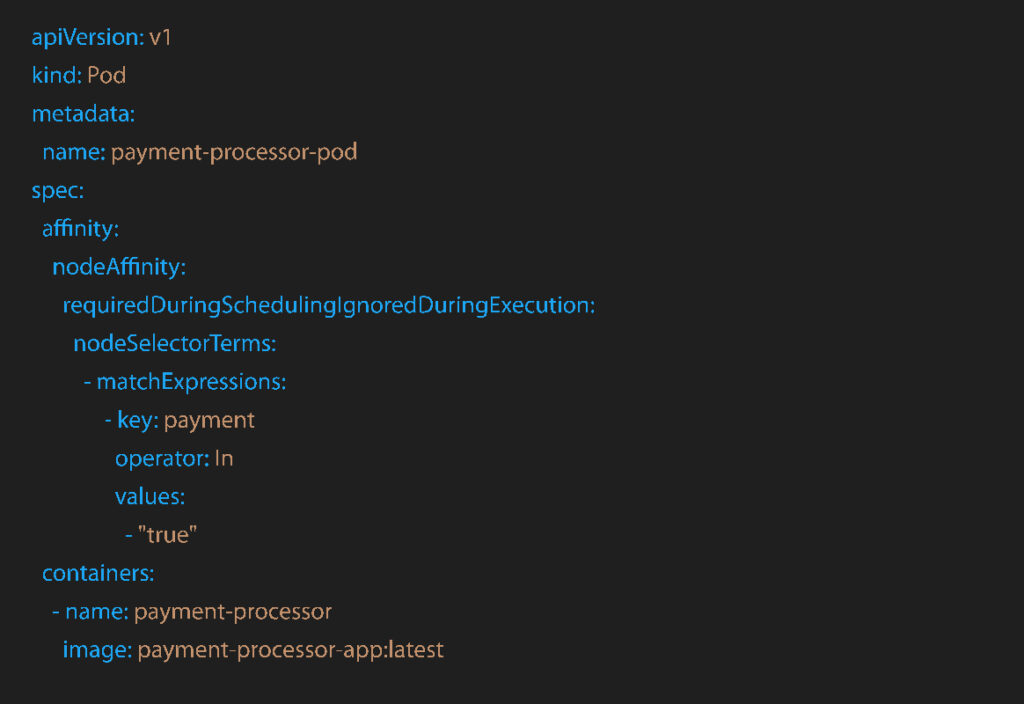

Use Case 2: Isolating Sensitive Banking Services

-

Payment processing workloads should be separated from general banking services for security.

-

Solution: Assign sensitive workloads to dedicated high-security nodes.

-

Benefit: Protects sensitive data and meets regulatory security mandates

-

2. Pod Affinity: Grouping Related Workloads Together

👉 What is Pod Affinity? It enables specific pods to be scheduled close to each other on the same node or region.

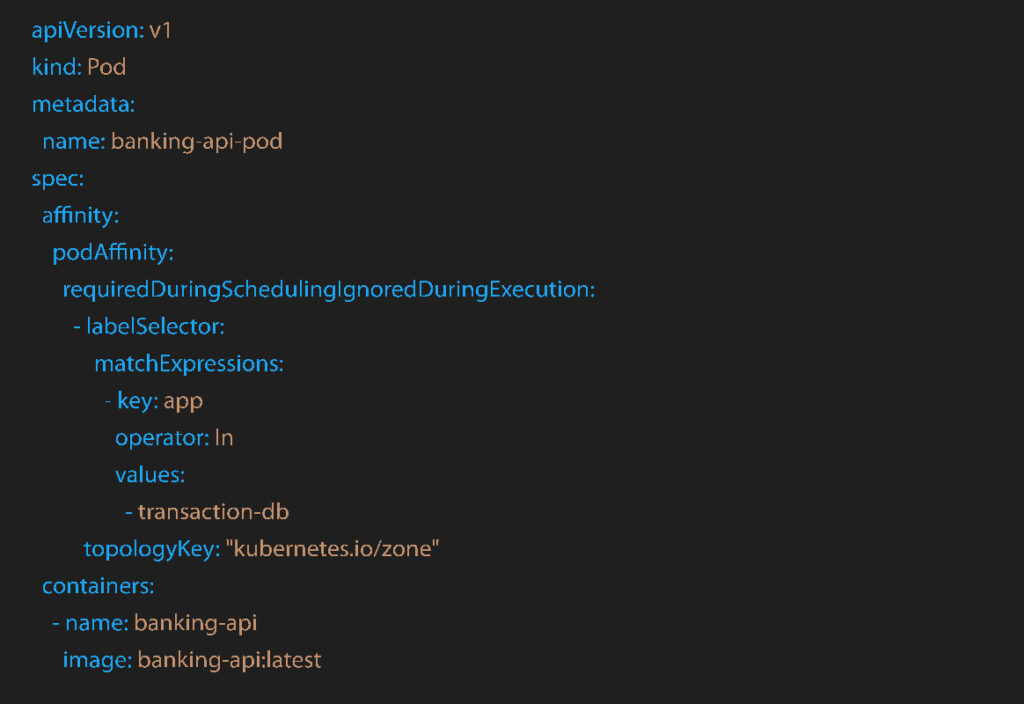

Use Case 1: Reducing Latency in Real-Time Payment Systems

-

A bank’s real-time payment processing needs low-latency communication between API servers and transaction databases.

-

Solution: Apply pod affinity so API servers are scheduled near transaction databases.

-

Benefit: Improves performance and speeds up transaction processing.

Use Case 2: Enhancing Security with Zero Trust Architecture

-

Microservices that handle sensitive customer data should be placed close to security services (e.g., authentication, encryption, and monitoring services).

-

Solution: Use pod affinity to group security services with critical workloads.

-

Benefit: Enforces zero trust principles by ensuring security services are always nearby.

-

3. Pod Anti-Affinity: Ensuring High Availability by Spreading Workloads

👉 What is Pod Anti-Affinity? It prevents Kubernetes from placing multiple critical pods on the same node, improving fault tolerance.

Use Case 1: Compliance & Data Segmentation

-

Certain workloads must be isolated for compliance purposes, such as PCI-DSS requirements for cardholder data.

-

Solution: Use pod anti-affinity to separate workloads that handle different data classifications.

-

Benefit: Reduces risk of unauthorized data access and improves compliance adherence.

Use Case 2: Preventing API Downtime in Online Banking

-

If all API service replicas are on the same node, a single node failure can bring down the entire banking system.

-

Solution: Use pod anti-affinity to distribute API replicas across different nodes.

-

Benefit: Increases fault tolerance and prevents downtime.

Example Snippet:

Wrapping Up

Financial institutions gain specific advantages from well-implemented Kubernetes pod placement strategies:

- Regulatory Compliance: Meet data residency and segmentation requirements

- High Availability: Prevent system-wide failures through distributed workloads

- Security & Isolation: Separate sensitive workloads from general services

- Zero Trust Implementation: Keep security services near critical applications

- Auditability: Maintain clear boundaries for effective logging and monitoring

For financial organizations using cloud-native technologies, proper Kubernetes pod placement directly supports business continuity, security, and customer trust. Next Steps: Contact our Kubernetes consulting services team at [email protected] or schedule a consultation to discuss how these strategies can be implemented in your environment.

We turn your toughest challenges into measurable growth—let’s connect and explore how.